Benefits of Tally Prime Integration Software for eCommerce Sellers

Whether eCommerce or any other business, accounting is an integral part of any business. One needs to handle this aspect appropriately and without fail. As a business owner, it is vital that you know about all the transactions and financial flow of your business. Mishandling the accounting part can make or break your business; excellent accounting management can help you have a robust business base. It will never let you lose a single penny and will add more profit to your online business. An impeccable accounting system secures your future and can even help you escape unusual situations in your hard times.

You must have a thorough record of your payments and transactions. Generally, most sellers extensively use Tally PRIME to manage the accounting part of their online business for bookkeeping and managing inventory and finances, invoicing, reporting, sales and purchase management, etc. The eCommerce business is considered one of the most complex businesses when it comes to accounting specifically. You need to keep track of and record your multiple transactions and payments. However, it is not an easy task to implement because it may invite a bunch of errors.

However, Tally PRIME integration software can resolve all these difficulties for you. You can save inventory, transactions, sales, and taxation data into your Tally database. It is a business management software widely used by many small and large businesses. You can get rid of so many complexities of eCommerce by integrating tally prime with advanced software. This blog has mentioned some of the exceptional benefits of Tally PRIME integration software for eCommerce businesses.

Use Cases while managing Accounting in Online Selling

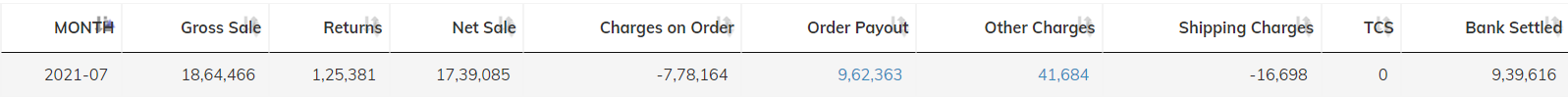

In the eCommerce business, you may receive hundreds of orders from various marketplaces every day. While selling your products on major eCommerce platforms such as Amazon, Flipkart, and Myntra, you must follow the GST guidelines and file the GST returns on time. These marketplaces also report your sales to the GST authorities by depositing the TCS (Tax collected at source) on your behalf.

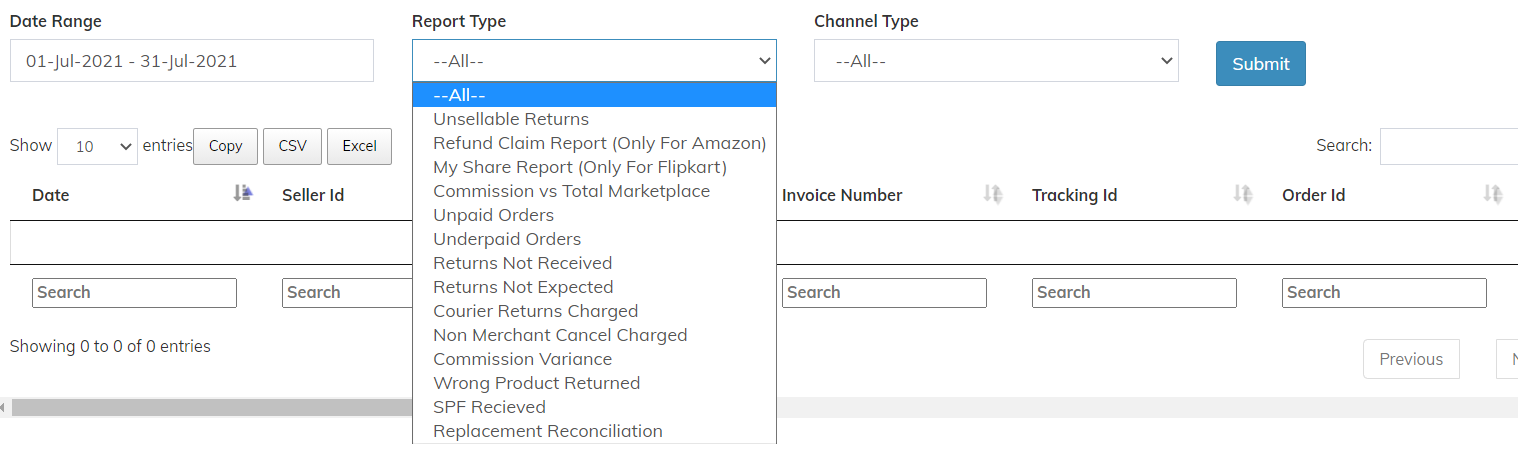

However, doing it manually can be time-consuming, and there may also be chances of errors. That is why you need automated software to integrate the eCommerce platforms’ transactions with Tally PRIME. Software like eVanik OWS provides seamless one-click integration of diversified eCommerce platform transactions with Tally PRIME. Here are some of the use cases in the process of accounting and bookkeeping:

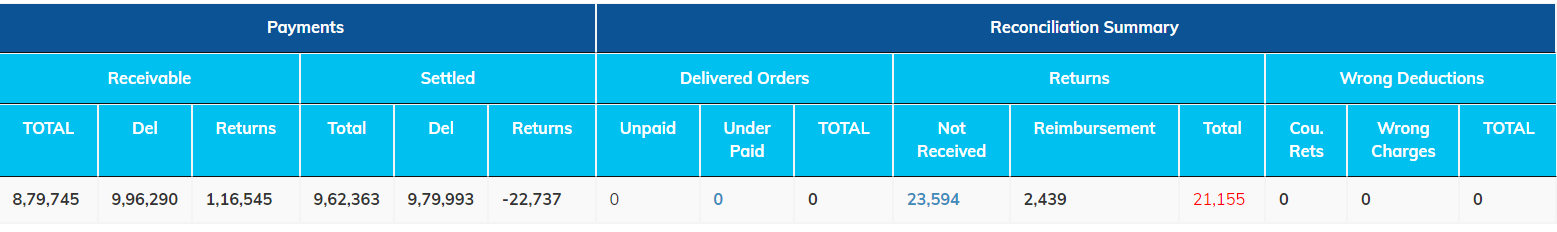

- In the process of sales and customer returns, it can be practically impossible for the sellers to insert numerous customer ledgers in the Tally. The marketplaces directly make the payments to every individual seller, and it can become a massive task for you to keep a manual record of bulk payments received against every order by the marketplaces.

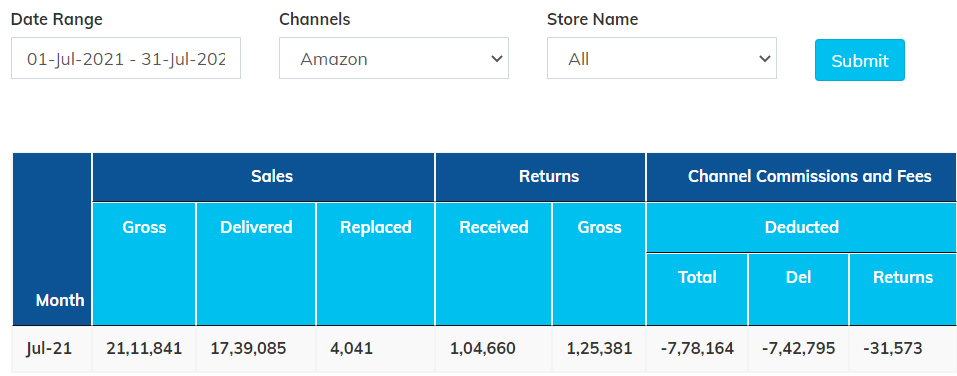

- The eCommerce platforms settle the net payment to the sellers after deducting various fees, charges and commissions. They provide a monthly commission invoice to the sellers that must be documented as an expenditure to avail of GST input credit. Apart from that, the commissions of marketplaces against every particular order need to get balanced out and matched.

- Customer and courier returns need to be resolved against the original invoices. Doing it in a traditional way may involve the risk of several errors, which can impact the overall health of your business.

- The sales and returns invoices must be accurately matched with the sales tax report and the MTR report provided by the eCommerce channels on your seller panels.

Exquisite Benefits of Tally PRIME Integration Software

Enhanced Accounting Operations

As an eCommerce seller handling the details of every online transaction and payment can become troublesome, especially when you are doing it manually, as it increases the chance of several errors. However, Tally PRIME integration software provides a techno hand to handle the accounting operations.

This advanced software provides you with an auto-generated report. Software like eVanik OWS helps in operating and analyzing financial statements and other tasks related to your online business; one is GST compliance. You don’t need to manually download and upload any excel sheet or CSV files from marketplace seller panels. All these data automatically get synced with this outstanding integration software.

Eliminate Errors and Saves Time

Nowadays, eCommerce business requires automation. Because manually doing the data transmission into a Tally increases the chances of human error. However, with eVanik OWS which is a Tally Prime integration software, you can eliminate manual errors and save a lot of time.

It can also eliminate the contrary data input. Data contradiction and manual errors can become a significant pain for you, and it’s better to eradicate them as soon as possible. The way to eliminate these annoying problems is to integrate your accounting software like Tally with this advanced software.

Effortless GST Return Filing

GST return filing is a vital part of any business; when it comes to online business, you must compile various invoices and tax reports to get a return amount from the government. Using tally prime can be a good option, but you can make it the best option by integrating it with advanced software.

This software can automatically compile all your invoices in one place and helps file the GST on time. Due to the mismanagement of invoices and tax reports, you can sometimes miss a suitable date to file the return. But with the help of integration software such as eVanik, you can file your GST return accurately and on time.

Hassle-Free Inventory Management

There is no need to explain that inventory management is essential to the eCommerce business. Most of the sellers use Tally Prime to manage their inventory as well. It stimulates the proper management of stocks, invoices, and product categories. However, they need to insert the data into the tally system manually. But with Tally PRIME integration software, you can get agile reports on inventories.

It will let you know how many products are left in a specific category and how many are sold out in this way. You can easily update your inventory and never miss a chance to delight your customer. Through this software, you can manage the inventory of various marketplaces in a single dashboard. You can maintain the stock inventory in a proper batch and can even monitor your products’ expiry dates. It ensures that none of your products get wasted.

Conclusion

Hence, this is how Tally PRIME integration software works for an eCommerce business. It is helpful not only in managing your accounts but your inventory as well. Both are an essential part of any online business, and you should not ignore them in any circumstances. So think twice before not considering the benefits of this software.

In the manner of saving a small amount of money, you get into a hefty financial loss. Believe it or not, currently, many sellers rely on this software and minimize the chance of loss and business failure. Subscribe with eVanik today, and acquire all the benefits mentioned above for your eCommerce business.