Process and Practices for Payment Reconciliation!

In the past several years, numerous businesses have shifted to eCommerce marketplaces because of the drastic change in customers’ demands and preferences. The internet-savvy consumers prefer to shop for almost everything from an online store. Along with the inflation of online shopping, the necessity for payment reconciliation has also arisen for online sellers. Payment reconciliation is basically a technique of managing your bank transactions and matching them with your accounting system.

However, sellers can find several issues regarding the payment reconciliation, and they need to sort them out within the time. Especially for online businesses, payment reconciliation has become one of the challenging processes to resolve. Sellers must now have a straightforward and hassle-free reconciliation process to handle the flow of payments. Assembling thousands of transactions across multiple eCommerce channels can be stressful work. Moreover, errors regarding such a process can cost you in a negative manner. However, to resolve payments-related issues, you can get along with eVanik OWS; it works as an online payment reconciliation software for sellers.

Apart from that, you require some best practices to implement for this process. In this blog, we have mentioned the beneficial practices that sellers should follow for an astounding payment reconciliation process.

Process of Payment Reconciliation

There are four essential steps of payment reconciliation that we have mentioned below. These steps can help you to learn more about this process. Lets’ see what those major steps are.

Data Extraction

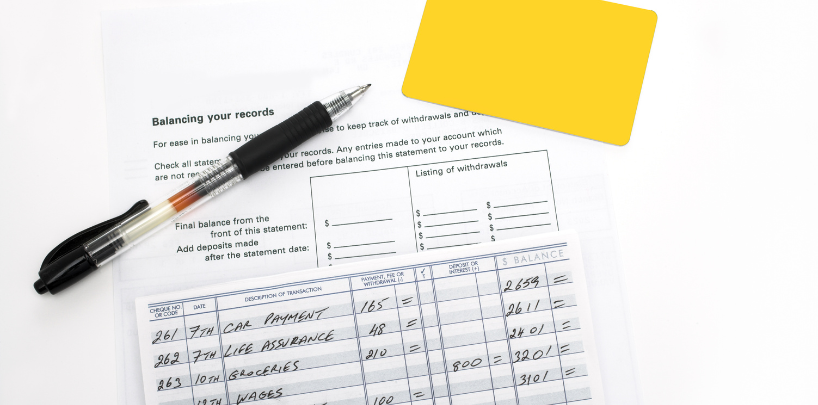

In the process of executing the payment reconciliation process, data extraction is the initial step that you need to apply. In this significant step, first of all, your bank statements and other transactions get extracted to compile them properly. You can get this data in the form of PDF or in a printout manner. Performing this step manually can be highly prone to human errors. That is why you may require to adopt online payment reconciliation software such as eVanik. It can integrate with your system and extract data from various marketplaces. You can view all the transactions in one single panel.

Matching

In this step, all the extracted data should get matched with each other. At this step, you need to match all the financial transactions carefully, and you can match these data by creating a traditional excel sheet if all are compiled relatively in a simple manner. However, matching it through a manual process can be a clumsy affair. So it is advisable to use any automated AI-based software to implement the matching process accurately and effectively.

Reconciliation

Reconciling is the most important step of this whole process that is related to reconciling all the products’ prices you have sold. In this step, you need to reconcile all the internal and external payment records. As an online seller, you must check that these two are matching with each other or not. To make this step successful, you need to implement the above steps adequately and efficiently.

Finalization

As the heading already indicates that it is the final step of this process. At this stage, you need to recheck all your financial flow and make sure there are no errors left. After that, you have to enter all the transactional pieces of information into your system. During this final process, it will be best if you take the help of an automated payment reconciliation software such as eVanik OWS.

Best Practices to Make this Process Efficient and Simple

Follow the Standard Process

Every eCommerce seller and brand does the payment reconciliation process weekly, monthly, and quarterly. If you want to experience enormous growth in your business, you should follow all the reconciliation steps such as data extraction, data matching, reconciliation, and finalization of data. You follow these standards to ensure accuracy and consistency and avoid several mistakes. It is essential to document all the procedures involved in the reconciliation process and develop templates you can readily follow. You should review it daily to eliminate gaps, and you must look forward to automating these procedures. Following these steps can help you streamline this process.

Implement Internal Control

To execute the eCommerce payment reconciliation process, you need to implement internal controls. It is vital to consolidate a series of internal checks that may recognize and disclose any possible errors, such as clerical errors. Internal controls can be implemented in the whole standardization Process depending on your online business type. These internal controls compensate for risk reduction, strong integrity, and the management of error fee transactional statements in a consistent manner.

Grasp the Payment Conversion

Payment methods have changed briskly in the past few years. Digitization brings multiple payment options and promotes the transformation in payment sections. While shopping from an eCommerce platform, customers prefer cashless payments these days, and to meet their demands, you have to grasp the various payment conversions. Rather than cash payment, Google pay, Paytm, and Phonepay have taken over the market. Now you can experience that you have numerous vendors to reconcile regularly.

Implicate eCommerce Reconciliation Software

Generally, errors arise in the Payment reconciliation process when you execute data analytics. You can spend your maximum effort extracting, selecting, and loading the data despite identifying the results and assuring error-free transactional statements. However, various software providers in the eCommerce industry can provide you with software related to payment reconciliation. This software provides sturdy solutions to eliminate errors related to this process quickly. This software involves some of the technological solutions that naturally extract and assemble the financial pieces of information from your ERP system, or it can precisely etch it from multiple eCommerce channels you are associated with and sell your items. Such software provides you with an auto-generated list of all your transactions in a monthly, quarterly, and annually format. Such software clarifies the mode of payment, product cost, and vendors’ commission.

Conclusion

Payment reconciliation is indeed a time taking process. However, the steps mentioned above and the process can efficiently aid the finance and accounting part in successfully implementing the work. A well-established reconciliation process can help you avoid paying reprehensible fees to eCommerce platforms, avoid overdrafts and monitor your financial cash flows.

Doing this process manually involves several errors that can drastically ruin your business. To resolve your payment-related issues, you must take the help of online payment reconciliation software like eVanik. It provides all the necessary transactional information in an automated manner. The automatic process saves time and money, eliminates every single transactional error, and provides a clearer view of your transactions.

A successful eCommerce business can not get established without a robust payment reconciliation system. In the end, you do any business to earn a decent revenue, but if you lack in this process, you can not get expected success. It will be best if you always sort matters related to finances at any cost.